Personal finance involves managing individual assets, expenses, and savings, focusing on long-term financial security. On the other hand, business finance encompasses activities such as financial planning, raising capital, and strategic financial decision-making to drive the growth and success of a business entity.

While both require effective financial management, the objectives and scope differ significantly, highlighting the importance of understanding and managing each type of finance independently.

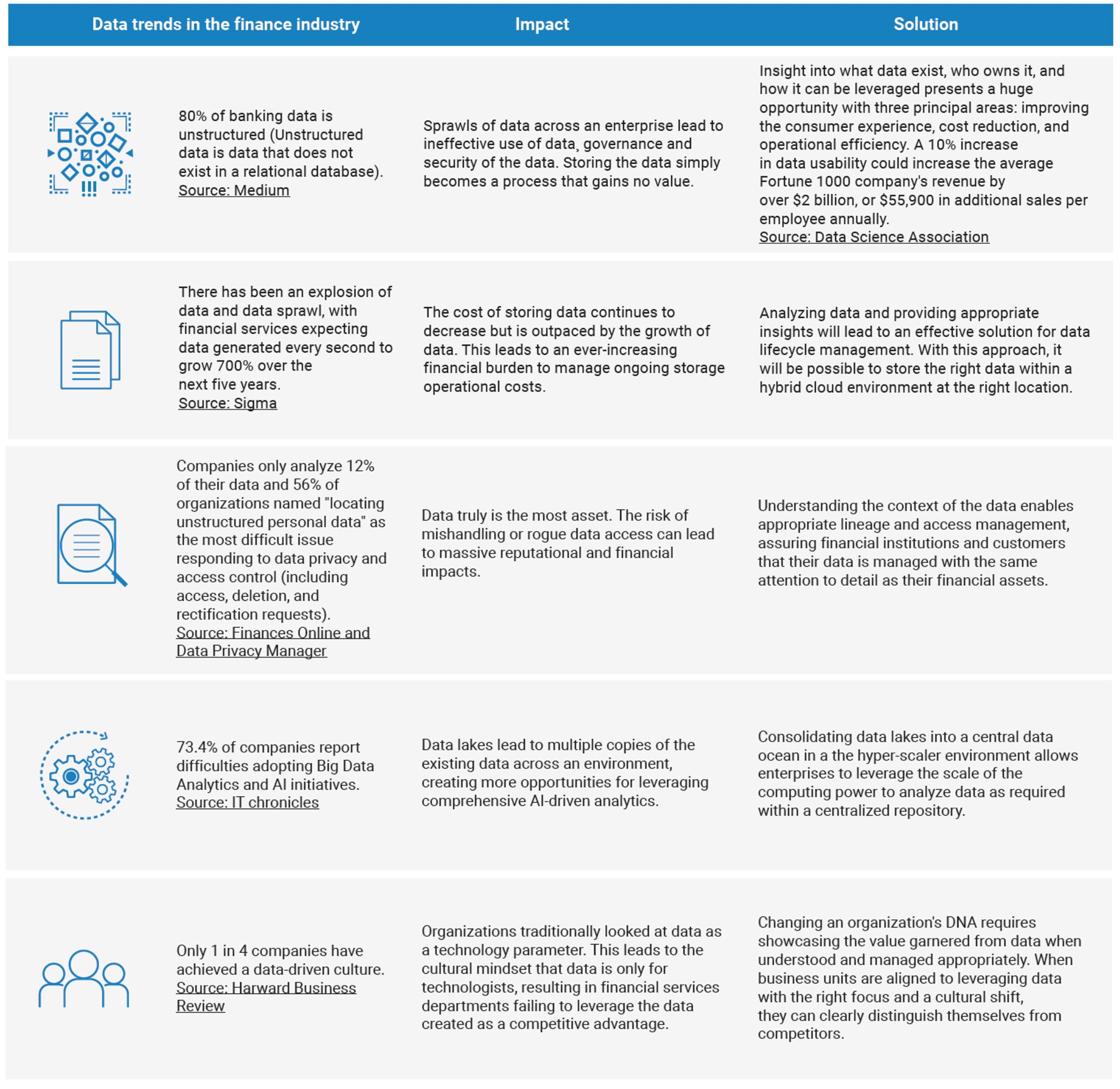

Credit: www.datadynamicsinc.com

Understanding The Difference

When it comes to managing finances, it's important to understand that personal finance and business finance are two distinct aspects. Each has its own set of principles and strategies, serving different purposes. Let's delve into the specifics of Personal Finance and Business Finance to discern their differences.

Personal Finance

Personal finance refers to the management of an individual's financial resources. This entails budgeting, saving, investing, and planning for expenses such as education, retirement, and healthcare.

Business Finance

On the other hand, business finance pertains to the financial management of a company or organization. It involves acquiring funds for business operations, capital investment, financial planning, and decision-making to ensure the growth and sustainability of the business.

Importance Of Separating Finances

Understanding the difference between personal finance and business finance is crucial. Personal finance refers to managing individual or household assets, while business finance deals with funds and credit employed in a business. Separating these finances is essential to maintain distinct financial portfolios and ensure clear financial accountability.

Avoiding Confusion

By separating business and personal finances, you avoid confusion.

Legal And Tax Implications

Separating finances ensures compliance with legal and tax requirements.

Professional Image

Keeping finances separate helps in maintaining a professional image.

Separating personal and business finances is crucial for distinct financial management.

- Prevents confusion in financial transactions

- Ensures legal compliance and proper tax filing

Separating business and personal finances helps maintain a professional image.

Financial Strategies

When it comes to managing finances, both personal finance and business finance require effective strategies to achieve long-term goals and financial stability. However, there are significant differences in the approaches and techniques used in each. In this article, we will explore the key financial strategies employed in personal finance and business finance.

Investment And Leverage

In personal finance, investment typically revolves around individual goals such as saving for retirement, purchasing a home, or building an emergency fund. Individuals often invest in stocks, bonds, mutual funds, and real estate to grow their wealth over time. Leverage is not commonly used in personal finance as it carries potential risks and requires a deep understanding of the market.

On the other hand, business finance heavily relies on investment and leverage to achieve growth and maximize profits. Businesses often borrow funds to invest in assets, expand operations, or acquire other companies. Leveraging borrowed money allows businesses to multiply their returns, assuming the investment generates a higher rate of return compared to the interest expense. However, leveraging also increases the risk, as businesses need to make sure their investments generate sufficient returns to cover the debt obligations.

Risk Management

In personal finance, risk management primarily focuses on protecting assets, establishing insurance coverage, and diversifying investments. Individuals may hold insurance policies to mitigate the potential financial impact of accidents, illness, or property damage. Additionally, diversifying investments across different asset classes helps reduce the overall risk exposure.

Businesses, on the other hand, employ a more complex approach to risk management. They need to assess potential risks across various dimensions, such as market volatility, competition, regulatory changes, supply chain disruptions, and financial instability. Businesses often utilize risk management tools such as hedging, insurance, contingency planning, and strategic partnerships to mitigate risks and ensure continuity.

Long-term Planning

Both personal finance and business finance require long-term planning to achieve financial goals. However, the scope and complexity differ significantly.

In personal finance, long-term planning typically focuses on retirement planning, education funds, debt repayment, and major life events like buying a home or starting a family. Individuals set financial goals, create budgets, and allocate resources accordingly. They also regularly review and adjust their plans to accommodate changing circumstances.

In contrast, business finance involves extensive long-term planning to guide overall corporate goals and growth strategies. Businesses need to take into account market trends, competitive landscape, technological advancements, economic conditions, and regulatory factors. This often involves creating comprehensive financial projections, assessing investment opportunities, setting sales and revenue targets, and formulating strategic business plans.

Overall, while personal finance and business finance share commonalities in terms of budgeting, paying taxes, and investments, the strategies employed in each differ significantly. By understanding the distinct financial strategies in personal and business finance, individuals and businesses can make informed decisions to achieve their respective financial objectives.

Credit: depositphotos.com

Managing Finances

Managing finances is an essential aspect of both personal and business life. However, there are distinct differences between personal finance and business finance. Understanding these differences is crucial for individuals looking to navigate their personal finances effectively and for business owners aiming to achieve financial success.

Tools And Technology

In today's digital age, both personal finance and business finance have benefited from advanced tools and technology. However, the specific tools used may vary depending on the context. For personal finance management, individuals can utilize various mobile applications and online platforms to track their expenses, set budgets, and monitor their financial goals.

On the other hand, businesses often rely on more sophisticated financial management software that integrates multiple functions such as accounting, inventory management, and payroll processing. These tools enable businesses to streamline their financial operations, make data-driven decisions, and optimize their overall financial performance.

Budgeting

Budgeting is a fundamental practice in both personal finance and business finance. However, the scope and complexity of budgeting differ significantly between the two.

When it comes to personal finance, individuals typically create budgets to manage their income, expenses, and savings. Personal budgeting involves allocating funds for various categories, such as housing, transportation, groceries, and entertainment, all while ensuring that income exceeds expenses.

In contrast, business budgeting encompasses a more comprehensive and strategic approach. Businesses need to forecast revenues, project costs, and allocate resources to different departments and initiatives. Moreover, businesses must consider both short-term and long-term financial goals, such as expanding operations, investing in new technologies, and increasing profitability.

Overall, while both personal and business finance require effective budgeting, the scale and complexity of budgeting differ significantly.

Credit And Debt Management

Credit and debt management play a crucial role in personal finance and business finance. However, there are notable distinctions in how credit and debt are managed in these two domains.

On a personal level, individuals strive to maintain a good credit score, manage their debts responsibly, and make timely payments. Personal credit and debt management involve strategies such as budgeting, paying off outstanding debts, and using credit cards responsibly to avoid excessive debt accumulation.

In the business world, credit and debt management become more complex. Businesses often rely on external financing, such as loans and lines of credit, to fund their operations, expand their facilities, or invest in new ventures.

Businesses must carefully manage their credit relationships with lenders, negotiate favorable loan terms, and diligently monitor their debt repayment obligations. Moreover, businesses need to balance their debt-to-equity ratios to maintain a healthy financial position and ensure the sustainability of their operations.

In conclusion, while personal finance and business finance share some common aspects, there are significant differences when it comes to managing finances. Understanding these differences is essential for individuals seeking financial stability and success in their personal lives and for businesses aiming to achieve sustainable growth and profitability.

Similarities And Differences

Personal finance and business finance differ in their application and focus. While personal finance involves managing an individual's assets and liabilities, business finance pertains to funding and managing a business's financial activities. Both share similarities in some aspects, such as budgeting and strategic goals, but they are distinct in their objectives and scope.

Budgeting And Planning

Budgeting: Both personal and business finance involve allocating funds for expenses.

Planning: Setting financial goals is crucial for individuals and businesses alike.

Investment Objectives

Personal Finance: Focuses on personal goals like retirement savings and wealth accumulation.

Business Finance: Aims at maximizing profits and growth for the organization.

Tax And Regulatory Considerations

Tax: Individuals and businesses must adhere to tax laws and optimize tax strategies.

Regulatory: Both personal and business finance require compliance with financial regulations.

Credit: m.facebook.com

Frequently Asked Questions For What Is The Difference Between Personal Finance And Business Finance

What Is The Big Difference Between Personal Finance And Business Finance?

In personal finance, individuals manage their money, while in business finance, funds are managed for business operations.

What Is The Difference Between Finance And Business Finance?

Business finance pertains to the funds and credit used in a business, while finance encompasses all financial decisions and activities of an individual or household. The major distinction lies in the use of leverage as an investment strategy, where businesses can borrow funds to invest and potentially increase financial gains.

How Do You Separate Personal And Business Finance?

To separate personal and business finance, follow these steps: 1. Put your business on the map. 2. Open a business checking account and get a business debit card. 3. Get a business credit card. 4. Pay yourself a salary. 5.

Separate and track receipts. 6. Track shared expenses. 7. Keep records of personal items used for business purposes.

What Are The Similarities Between Business And Personal Finance?

Both business and personal finance involve budgeting, taxes, investing, and strategic goal setting as key similarities.

Conclusion

Understanding the differences between personal and business finance is crucial. Leveraging borrowed funds differs significantly in both realms. While personal finance focuses on individual financial decisions, business finance involves managing assets for the company's growth. Separating these two areas is essential for financial success.

0 Comments